Global Frozen Potato Market Poised for Robust Growth: Key Trends, Challenges, and Leading Producer Countries

Mostafa Adel

The frozen potato market is experiencing significant expansion, with recent reports revealing promising growth projections. Valued at USD 67.27 billion in 2023, the global frozen potato market is forecasted to reach USD 89.51 billion by 2029, growing at a Compound Annual Growth Rate (CAGR) of approximately 5% during this period. This growth is driven by various factors, including the expanding foodservice industry, the rise of e-commerce, and changing dietary preferences globally. However, the market also faces challenges such as competition from fresh alternatives and regulatory issues. Here’s a closer look at the factors influencing the market’s trajectory and the key trends shaping its future, along with the top five producer countries driving the market.

Growth Drivers of the Frozen Potato Market

1. Expansion of the Foodservice Industry

One of the primary drivers behind the growth of the frozen potato market is the expanding global foodservice sector, which includes restaurants, fast-food chains, and catering services. In developing nations, there is an increasing trend toward the “westernization” of diets, where potatoes, particularly in the form of French fries, play a central role. As global fast-food chains like McDonald’s, Burger King, and KFC expand their operations, the demand for frozen potato products has surged. These chains rely on frozen products for their consistency, quick preparation time, and ease of storage.

Furthermore, the convenience factor has made frozen potatoes a staple in both foodservice and household kitchens. Consumers appreciate the ease of cooking and the long shelf life that frozen potatoes offer without compromising much on taste and nutrition.

2. Rise of E-Commerce and Online Grocery Shopping

The increasing reliance on e-commerce platforms and online grocery shopping has played a pivotal role in expanding the frozen potato market. These platforms make it easier for consumers to purchase frozen food products, including potatoes, from the comfort of their homes. This trend gained further momentum during the COVID-19 pandemic, and it continues to boost sales as more consumers embrace the convenience of digital grocery shopping.

3. Marketing and Promotional Activities

Major industry players are investing heavily in marketing and promotional campaigns to increase the visibility of frozen potato products. These campaigns aim

to position frozen potatoes as a convenient, affordable, and healthy option, while highlighting the versatility of the product for various cuisines. Enhanced visibility and consumer engagement are expected to contribute to increased sales across different regions.

Market Segmentation and Trends

The frozen potato market is segmented into several product types: French fries, hash browns, mashed potatoes, shaped, topped/stuffed, battered/cooked, and other variations. French fries hold the dominant market share and are expected to remain the fastest-growing segment throughout the forecast period. This segment’s growth can be attributed to the widespread availability of frozen fries in fast-food chains and the growing trend of at-home consumption.

Moreover, healthier versions of frozen potato products, such as oven-baked or air-fried fries, are gaining traction among health-conscious consumers. The demand for these healthier alternatives reflects broader consumer preferences for reduced-fat, low-calorie, and organic options. According to a 2023 report by Global Industry Analysts, the frozen potato category is increasingly focusing on product innovation, offering seasoned, flavored, and health-oriented products to meet evolving consumer demands.

Top 5 Frozen Potato Producers by Country

The global frozen potato industry is heavily reliant on several key producers that dominate both the cultivation of potatoes and their processing into frozen products. Below are the top five countries leading the production of frozen potato products:

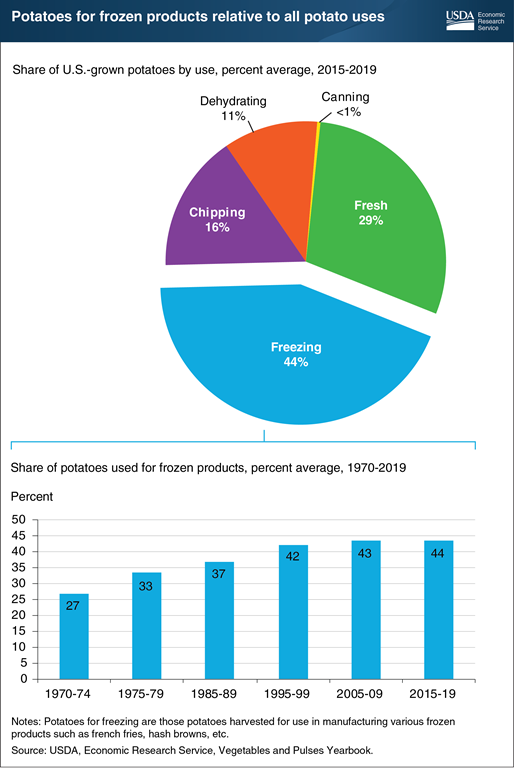

1. United States

The United States is the world’s largest producer of frozen potatoes, benefiting from a strong agricultural base, advanced processing technologies, and a well-established fast-food culture. Idaho and Washington are leading potato-growing states in the U.S., while companies like McCain Foods and Lamb Weston dominate the frozen potato market. The U.S. also benefits from a growing trend of home consumption, with frozen fries becoming a household staple.

2. Canada

Canada, home to one of the world’s largest frozen potato processors, McCain Foods, is a key player in the global market. McCain Foods, which originated in New Brunswick, has a large global footprint, with production facilities not only in Canada but across several continents. The country’s favorable agricultural climate and infrastructure, combined with innovations in processing and storage, have made Canada one of the top exporters of frozen potato products globally.

3. Belgium

Belgium is renowned for its high-quality frozen potato products, particularly its frozen French fries. The country is a major supplier to the European market and is increasingly expanding exports to other regions, including Asia and North America. Belgian producers have set industry standards for frozen potato processing and packaging, focusing on maintaining high product quality. Belgium’s strong potato processing industry, led by companies like Agristo and Lutosa, plays a critical role in the country’s economy.

4. Netherlands

The Netherlands is another European powerhouse in frozen potato production, with its strategic position allowing it to serve markets across Europe, Africa, and the Middle East. Companies like Farm Frites and Aviko are leading producers in the Dutch market, contributing significantly to global exports. The Netherlands is also known for its focus on sustainability and eco-friendly practices in potato farming and processing.

5. Germany

Germany is a leading producer of frozen potato products, driven by its strong domestic market demand and a thriving fast-food sector. The country has a well-established potato processing industry that caters to both domestic consumers and export markets. Additionally, Germany’s focus on quality and its growing trend towards organic and sustainably sourced products are expected to boost its standing in the frozen potato industry in the coming years.

Regional Insights: Key Players Driving Market Growth

1. North America

North America is currently a leading region in the frozen potato market, with the United States accounting for the largest share. The growth of this market can be attributed to the rising consumption of convenience foods, particularly among the working population and younger demographics. The increasing demand for snack foods is another factor driving market growth in the U.S., where products like frozen French fries have become an integral part of everyday meals and fast food culture.

2. Europe

In Europe, Germany stands out as a major player due to its well-established food industry and high consumer demand for ready-to-cook froz

en foods. Quick-service restaurants (QSRs) in Germany are significant consumers of frozen potato products, with companies like McCain Foods dominating the market by supplying to both retail and foodservice sectors. Additionally, the trend towards eco-friendly and sustainable food production is influencing the growth of organic frozen potatoes, which cater to environmentally-conscious consumers.

3. Asia Pacific

Asia Pacific is expected to see the fastest growth in the frozen potato market, with India being a key contributor. India’s growing fast-food industry, along with its youthful and rapidly urbanizing population, has led to increased consumption of frozen potatoes. Global fast-food brands are continuing to expand across the region, while local vendors and street food stalls also incorporate frozen potato products into their offerings. Improved cold chain infrastructure, supported by government initiatives, is further facilitating market expansion in the region.

Egyptian IQF Frozen Potatoes

Challenges and Emerging Trends

Despite the strong growth outlook, the frozen potato market faces challenges. Fresh potatoes are often perceived as having superior taste, texture, and nutritional value compared to frozen alternatives, leading some consumers to prefer fresh products. Additionally, regulatory compliance and supply chain disruptions may pose hurdles for the frozen food industry.

However, emerging trends offer new opportunities for market growth. The rise of plant-based and vegan diets have prompted manufacturers to develop more diverse product offerings, such as seasoned or flavored frozen potatoes. Consumers are increasingly seeking healthier alternatives, including low-fat, baked, or organic frozen potatoes. Companies are responding by offering innovative products to cater to these preferences, which could offset some of the challenges the market faces.

Additionally, sustainability is becoming a key concern in the frozen food industry. Companies are adopting eco-friendly packaging and production methods to align with consumer demand for sustainable products. This focus on environmental responsibility is likely to drive growth in the coming years.

Conclusion

The global frozen potato market is on a steady growth path, driven by the rising demand for convenience foods, the expansion of fast-food chains, and the increasing popularity of e-commerce platforms. With innovative product offerings and a focus on sustainability, the market is well-positioned to meet evolving consumer demands. However, manufacturers must navigate challenges such as competition from fresh alternatives and regulatory requirements. As consumer preferences continue to shift towards healthier, more eco-conscious products, the frozen potato industry will need to adapt to remain competitive and capture new opportunities in this dynamic market.

Best Regards

Mostafa Adel

Last updated November 10, 2024