The European Market for Frozen Berries: Trends, Opportunities, and Forecast

Mostafa Adel

Frozen berries have become a vital component of the European food market, offering a blend of health benefits, convenience, and year-round availability. Despite recent economic challenges, the market is set to grow at an annual rate of 1–2% in the coming years. Key importing countries include Germany, France, the United Kingdom, the Netherlands, Belgium, and Italy. This article provides an in-depth forecast for the frozen berry market, highlighting key trends, challenges, and opportunities for producers, exporters, and businesses.

1. Overview of the European Market for Frozen Berries

Europe accounts for 56% of global imports of frozen berries, driven by consumer preferences for healthy, plant-based foods. Frozen berries, used in smoothies, breakfast bowls, bakery goods, and beverages, offer longer shelf life, convenience, and minimal waste compared to fresh produce. While the market experienced fluctuations due to inflation and high energy costs, the outlook for the next five years is optimistic as inflation stabilizes and demand returns.

2. Key Frozen Berry Products and Their Uses

The frozen berry segment includes a variety of berries, each with specific qualities and applications:

- Strawberries (Fragaria × ananassa): A versatile berry used in jams, desserts, and smoothies.

- Blueberries (Vaccinium spp.): Known for their antioxidant properties, available in wild and cultivated varieties.

- Raspberries (Rubus idaeus L.): Popular for their delicate flavor, available in red, black, and yellow types.

- Blackberries (Rubus fruticosus): Valued for their unique taste, often used in sauces and baked goods.

Frozen berries are sold in multiple formats to meet diverse market needs:

- Individually Quick Frozen (IQF): Premium whole berries ideal for direct consumption.

- Block-frozen: Used in food processing for jams and purees.

- Sliced or Crumbled: Applied in smoothies, bakery fillings, and desserts.

3. Market Trends and Challenges

3.1 Impact of Economic Conditions

Economic uncertainty, inflation, and energy price increases in 2022–2023 suppressed consumer demand for premium products like berries. However, as energy prices stabilize and inflation declines, demand is expected to recover.

3.2 Sustainability and Reduced Food Waste

Frozen berries align with sustainability trends by reducing food waste. Due to their long shelf life, frozen fruits experience significantly less spoilage compared to fresh ones. This trend supports consumer preferences for environmentally friendly products.

3.3 Growing Demand for Healthy, Plant-Based Foods

The shift toward plant-based diets has increased the demand for frozen berries. Smoothies, non-dairy yogurts, and breakfast bowls are driving consumption, particularly in the retail sector.

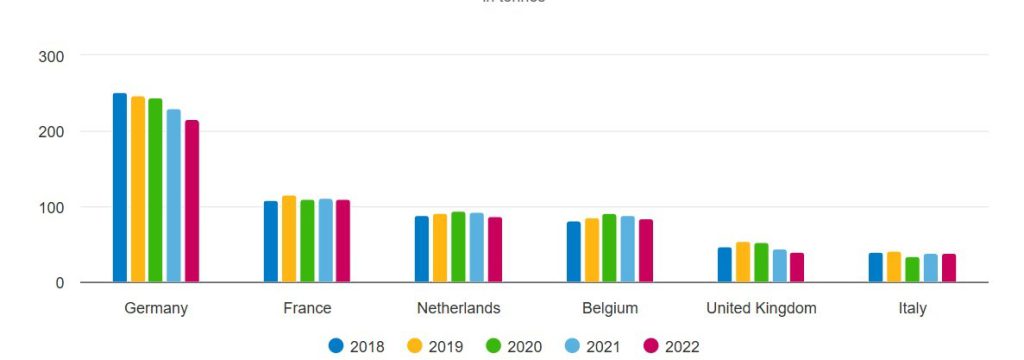

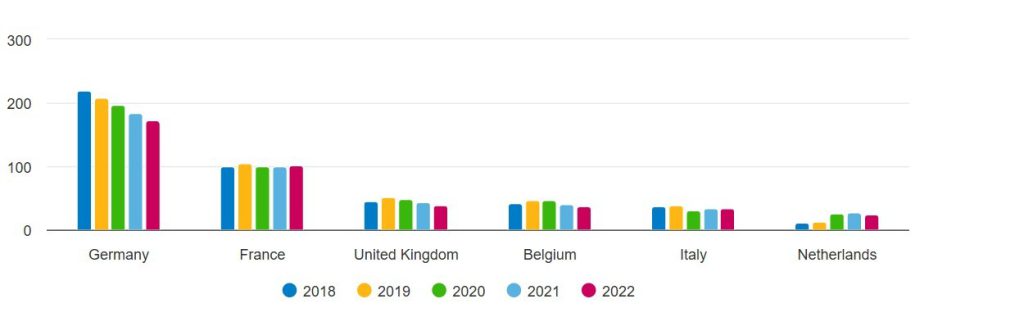

4. Country-Specific Market Insights

4.1 Germany: Largest Importer of Frozen Berries

Germany is Europe’s top importer, with 213,000 tonnes of frozen berries imported in 2022. Although imports contracted by 3.7% annually between 2018 and 2022 due to rising costs, organic berries are gaining popularity. Germany’s organic food market presents opportunities for exporters who meet certification standards.

- Key Products: Frozen strawberries and raspberries

- Top Suppliers: Egypt (leading exporter of strawberries) and Poland

- Trends: Growing interest in organic products and private-label retail brands

4.2 France: The Jam Industry’s Major Player

France’s strong jam industry, led by brands like Andros and Bonne Maman, drives demand for frozen berries. With imports growing by 0.6% annually between 2018 and 2022, the country remains a stable market for frozen fruit.

- Key Products: Frozen strawberries and raspberries

- Top Suppliers: Morocco, Serbia, and Poland

- Trends: Increasing use of berries in smoothies and ready-to-blend products

4.3 United Kingdom: Smoothies Lead the Way

The UK’s market for frozen berries is driven by the smoothie segment, with brands such as Innocent and Naked leading the charge. Although imports declined by 3.9% annually between 2018 and 2022, frozen berries gained popularity in 2023 as consumers sought cost-effective alternatives to fresh produce.

- Key Products: Frozen strawberries and raspberries

- Top Suppliers: Egypt, Poland, and Serbia

- Trends: Shift toward private-label products and value-for-money shopping

4.4 Belgium: A Strategic Trade Hub

Belgium serves as both a major consumer and re-exporter of frozen berries, with companies like Crop’s and Greenyard Frozen leading the market. Imports grew by 1.2% annually from 2018 to 2022, reflecting Belgium’s strategic trade position.

- Key Products: Frozen strawberries and raspberries

- Top Suppliers: Egypt, Peru, and Morocco

- Trends: Growth in smoothie consumption and out-of-home food services

4.5 Netherlands: An Export-Driven Market

The Netherlands is a key re-exporter of frozen berries, with imports stabilizing at 87,000 tonnes in 2022. While demand for frozen berries slowed due to shifting trade patterns, long-term prospects remain positive, supported by trends toward plant-based eating.

- Key Products: Frozen strawberries and blueberries

- Top Suppliers: Egypt, Morocco, and Ukraine

- Trends: Increased consumption of smoothies and healthy foods

4.6 Italy: Focus on Blueberries and Strawberries

Italy’s frozen berry market is driven by demand for frozen strawberries and European blueberries. With imports declining slightly by 0.6% annually, Italy’s position as a key importer remains intact, bolstered by strong consumer interest in health foods.

- Key Products: European blueberries and strawberries

- Top Suppliers: Egypt, Poland, and Ukraine

- Trends: Use of berries in jams, spreads, and bakery products

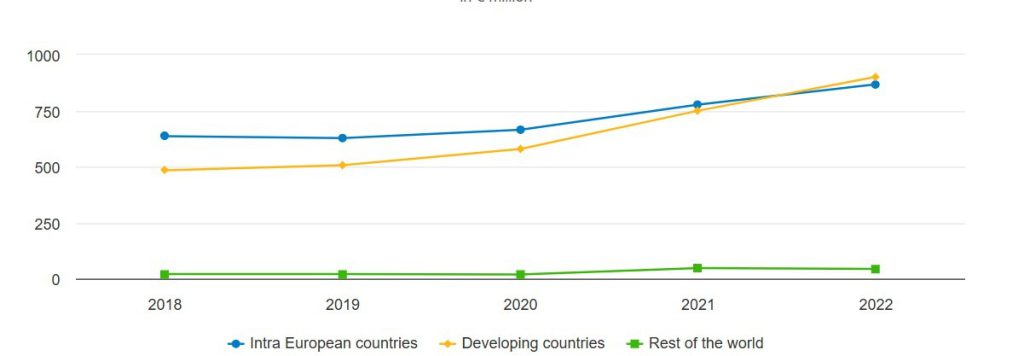

5. Opportunities for Developing Country Exporters

Developing countries play an increasingly important role in Europe’s frozen berry market. Imports from these countries grew by 17% annually between 2018 and 2022, reaching a value of €901 million. Egypt, Morocco, and Ukraine have emerged as key suppliers, with Egypt dominating the frozen strawberry segment.

6. Forecast and Future Outlook

The European frozen berry market is expected to grow by 1–2% annually over the next five years, driven by:

- Stabilization of inflation and energy prices

- Increasing demand for organic and sustainable products

- Growth in plant-based food consumption

- The popularity of smoothies and healthy snacks

While economic challenges remain, the outlook for frozen berry imports is positive. The sector’s alignment with health and sustainability trends ensures its relevance in both retail and industrial markets.

7. Conclusion: Strategic Path for Success

The frozen berry market in Europe offers numerous opportunities for producers and exporters. Businesses that focus on organic certification, sustainability initiatives, and innovative product development will thrive in this growing market. As consumers prioritize healthy eating and convenience, frozen berries will continue to play a pivotal role in shaping the future of Europe’s food industry.

For producers and exporters, staying informed about economic developments, consumer trends, and sustainability regulations will be essential for long-term success.

Best Regards

Mostafa Adel

Last updated November 10, 2024